An insight into risk management for small business owners

You’ve worked so hard to get to this point, how are you going to manage to keep your business afloat during uncertain times.

Understanding Risk Management:

Risk Analysis = Business Impact Analysis & Risk Assessment & Emergency Preparedness

The difference between emergencies and disasters. In simple terms:

- Emergencies are life threatening and have different effects.

- Disasters are a serious disruption of services.

One can prepare for emergencies in most cases, but not always for disasters.

Business Continuity is often referred to as “common sense”. It is all about:

- Taking responsibility for your business

- Enabling it to stay on course

- Building and Improving resilience for your business

- Identifying and protecting your key products and services

- Devising plans and strategies that will enable you to continue business operations and to recover effectively from any type of disruption

- Preventing damage to your reputation

How do you approach risk management as a small business?

All businesses are by law required to comply with the Occupational Health and Safety Act (85 of 1993) and its Regulations. One of the first things to comply with the OHS Act as a business is to establish a risk assessment and implement the actions necessary to eliminate or mitigate identified hazards and associated risks. This not only gives you insight into prevention methods, but also how to protect your staff, your infrastructure, your products / services, and your customers.

When implementing and monitoring your risk assessment, consider factors such as health and safety, quality of products and services, and environmental impact.

Develop an Emergency Plan. This plan should consider the risks identified and mitigation methods. Once you have developed this plan, every person in your business and associated with your business such as staff, suppliers, contractors, community, neighboring businesses, must be informed of and understand your emergency plan and procedures. Test your plan regularly and update it wherever you identify areas for improvement.

Once size does not fit all. Your risk assessments and emergency plans should be relevant to your business location, employees, equipment, raw materials, processes, infrastructure, technology, finances, products, services, insurance, customers, and service providers.

Surviving Emergencies / Disasters: without a plan – you have nothing

Were any of us prepared for Covid-19? The lockdowns, the shutdown of businesses? No.

Were any of us during this pandemic prepared for the Riots in July? No.

Yet here we are – trying to recover.

|

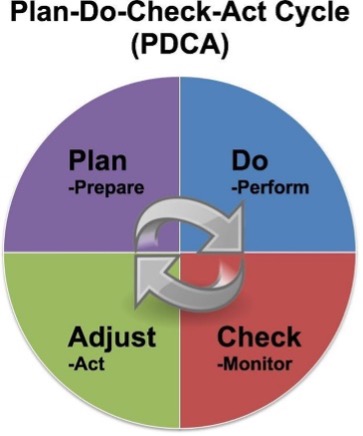

Incorporate the PDCA (Deming) Cycle into all your business planning.

PDCA is a known method and an essential business tool for all businesses, regardless of size.

- Plan: Your processes, risk assessment, procedures

- Do: Implement your processes, resources, procedures

- Check: Monitor (evaluate) the effectiveness

- Act: Take action to rectify and improve

Recovery: The aftermath (lessons learnt)

Insurance:

Insure your business, your income, your staff salaries. And, if you have not already done so, include SASRIA into your business insurance, regardless of whether you work from home, or have a shop in a mall, or an office in an office block.

Review:

Review your risk assessment – is it still realistic?

Review your emergency plan – is it still effective?

Business Continuity – can you work from elsewhere?

Funding:

Consider putting some funds away. It’s not easy as a small business, however without any backup funding to pay your suppliers and your employees, or get an income for yourself, your business will face the inevitable shutdown.

Communication & Alternative services:

Stay in touch with your customers. Let them know what you are doing to recover and how you will be providing your service / products to them. Consider other ways to provide services to them. You may need to think about remote online services, alternate suppliers, or even different products/services you can provide in the interim.

Remember you cannot risk losing your customers or your employees.

No customer = no business.

No employee = no production.

By: Sherry Pretorius

Director - SHEP Consulting (Pty) Ltd

0 comments